Introduction: Decoding the Digital Dough

Ever heard the buzzword “cryptocurrency” floating around? Maybe your tech-savvy friend keeps talking about Bitcoin or Ethereum, or you’ve seen news headlines about wild price swings. It can sound complicated, even intimidating. But at its heart, cryptocurrency is simply digital money. Think of it like the cash in your wallet, but instead of being physical bills and coins issued by a government, it exists purely as computer code, secured by some pretty clever technology.

This article aims to break down the mystery surrounding cryptocurrencies, explaining what they are, how they work, and why they’ve become such a big deal. We’ll skip the overly technical jargon and focus on providing a clear, easy-to-understand explanation for everyone, regardless of their tech background.

The Core Idea: Digital Money Without Borders (or Banks!)

Imagine sending money to a friend across the country or even across the globe without needing to go through a bank or a traditional payment processor. That’s the fundamental idea behind cryptocurrency. It’s designed to be decentralized, meaning no single authority, like a central bank or government, controls it.

Think of the internet itself. No single company owns the entire internet. Instead, it’s a network of interconnected computers. Cryptocurrency operates on a similar principle, using a distributed network of computers to manage and verify transactions. This decentralization offers several potential advantages:

- Lower Fees: Without intermediaries taking a cut, transaction fees can often be lower, especially for international transfers.

- Faster Transactions: In many cases, cryptocurrency transactions can be faster than traditional bank transfers, especially across borders.

- Greater Accessibility: Cryptocurrencies can potentially provide financial services to people who don’t have access to traditional banking systems.

- Increased Transparency: While your identity might not be directly linked to your transactions (pseudonymity), all transactions are typically recorded on a public ledger, making the system transparent.

The Magic Behind the Curtain: Blockchain Technology

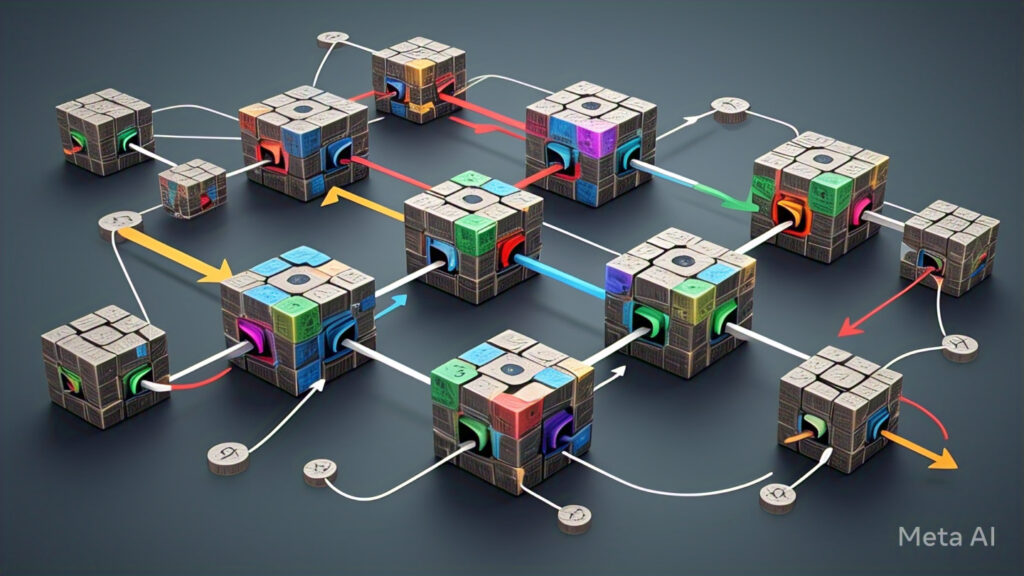

So, how does this decentralized digital money actually work? The key lies in a groundbreaking technology called blockchain. Think of a blockchain as a digital ledger, like a giant, constantly updated spreadsheet that everyone in the network has a copy of.

Here’s a simplified breakdown of how it works:

- Transactions are Bundled: When someone sends cryptocurrency to another person, this transaction is grouped with other transactions into a “block.”

- Verification by the Network: This new block of transactions is then broadcast to the entire network of computers participating in the cryptocurrency. These computers (often called “nodes” or “miners,” depending on the specific cryptocurrency) verify the legitimacy of the transactions. This verification process often involves solving complex mathematical problems.

- Adding to the Chain: Once the transactions in a block are verified, the block is added to the end of the existing “chain” of blocks – hence the name “blockchain.” This addition is permanent and cannot be altered.

- Secure and Transparent Record: Each new block is linked to the previous one using cryptography, making it incredibly difficult to tamper with the record. This creates a secure and transparent history of all transactions.

Imagine writing in a shared notebook where every new entry is checked and confirmed by everyone else with a copy, and once an entry is written, it can never be erased. That’s essentially what the blockchain achieves for cryptocurrency transactions.

Key Concepts Demystified: Wallets, Keys, and Mining

To truly understand cryptocurrency, it’s helpful to grasp a few core concepts:

Cryptocurrency Wallets: Your Digital Vault

A cryptocurrency wallet isn’t like a physical wallet that holds cash. Instead, it’s a software program or a physical device that stores your private keys and public keys, which are essential for sending and receiving cryptocurrency.

- Public Key: Think of your public key as your bank account number. It’s an address that you can share with others so they can send you cryptocurrency.

- Private Key: Your private key is like your PIN or password for your bank account, but much more critical. It’s a secret code that allows you to authorize transactions and spend your cryptocurrency. It’s absolutely crucial to keep your private key safe and never share it with anyone. Losing your private key means losing access to your cryptocurrency.

There are different types of cryptocurrency wallets, including:

- Software Wallets: These are applications you can install on your computer or smartphone.

- Online (Web) Wallets: These are accessible through a web browser. While convenient, they often involve trusting a third-party to secure your private keys.

- Hardware Wallets: These are physical devices that store your private keys offline, offering a higher level of security.

- Paper Wallets: These involve printing your public and private keys on a piece of paper. While secure if stored properly, they can be easily damaged or lost.

Mining: Creating New Coins and Securing the Network

In many cryptocurrencies, like Bitcoin, new coins are created through a process called mining. This isn’t like traditional mining for gold or silver. Instead, it involves using powerful computers to solve complex mathematical problems.

The miners who successfully solve these problems get to add a new block of verified transactions to the blockchain and are rewarded with a certain amount of newly minted cryptocurrency. This process serves two crucial purposes:

- Creating New Coins: It’s the mechanism by which new units of the cryptocurrency are introduced into circulation.

- Securing the Network: The computational power involved in mining makes it incredibly difficult for malicious actors to tamper with the blockchain.

However, not all cryptocurrencies use mining. Some use different mechanisms for creating new coins and verifying transactions, such as “staking.”

Why All the Fuss? The Potential and the Risks

Cryptocurrencies have generated a lot of excitement and debate. Here are some of the key reasons why:

Potential Benefits:

- Financial Freedom: The decentralized nature offers users more control over their money, free from the control of traditional financial institutions.

- Lower Transaction Costs: For certain types of transactions, especially international ones, fees can be significantly lower.

- Increased Transparency: The public nature of the blockchain allows anyone to view transactions (though not necessarily the identities of the participants).

- Potential for Investment Growth: The value of some cryptocurrencies has seen significant increases, attracting investors looking for high returns (though this also comes with high risk).

- Innovation in Finance (DeFi): Cryptocurrencies are the foundation for new and innovative financial applications, collectively known as Decentralized Finance (DeFi), which aim to recreate traditional financial services in a decentralized way.

Risks and Challenges:

- Price Volatility: The value of cryptocurrencies can fluctuate wildly and unpredictably, making them a risky investment.

- Security Risks: While the blockchain itself is secure, exchanges and individual wallets can be vulnerable to hacking and theft. Losing your private keys also means losing your funds.

- Regulatory Uncertainty: The legal and regulatory landscape for cryptocurrencies is still evolving, and regulations can vary significantly between countries.

- Complexity: Understanding the underlying technology and the nuances of different cryptocurrencies can be challenging for newcomers.

- Environmental Concerns: The energy consumption associated with mining some cryptocurrencies, particularly Bitcoin, has raised environmental concerns.

- Scams and Fraud: The popularity of cryptocurrencies has also attracted scammers and fraudulent schemes, making it crucial to be cautious.

Different Flavors of Crypto: Bitcoin and Beyond

While Bitcoin was the first and remains the most well-known cryptocurrency, the landscape has expanded dramatically. Today, there are thousands of different cryptocurrencies, often referred to as “altcoins” (alternative coins). Each has its own unique features, technologies, and goals.

Some popular examples include:

- Ethereum (ETH): Often described as a “world computer,” Ethereum is a platform that allows developers to build decentralized applications (dApps) using its own cryptocurrency, Ether.

- Ripple (XRP): Designed for fast and low-cost international payments.

- Litecoin (LTC): Often referred to as “silver to Bitcoin’s gold,” Litecoin aims to be a faster and more scalable alternative to Bitcoin.

- Cardano (ADA), Solana (SOL), Polkadot (DOT): These are examples of newer blockchain platforms with their own unique technologies and ecosystems.

- Stablecoins (e.g., USDT, USDC): These are cryptocurrencies designed to have their value pegged to a more stable asset, like the US dollar, aiming to reduce price volatility.

- Meme Coins (e.g., Dogecoin, Shiba Inu): These cryptocurrencies often gain popularity through viral internet trends and social media, and their value can be highly speculative.

Understanding that Bitcoin is just one type of cryptocurrency is important as you delve deeper into this space.

Getting Started (Cautiously!) with Cryptocurrency

If you’re curious about getting involved with cryptocurrency, it’s essential to proceed with caution and do your own research. Here are a few initial steps:

- Educate Yourself: Read articles, watch videos, and understand the basics of how cryptocurrencies work and the associated risks.

- Choose a Reputable Exchange: If you decide to buy cryptocurrency, select a well-known and secure exchange platform.

- Start Small: Don’t invest more money than you can afford to lose.

- Understand Wallet Security: Learn how to properly secure your cryptocurrency using different types of wallets.

- Be Wary of Scams: Be extremely cautious of promises of guaranteed high returns or any unsolicited offers.

Conclusion: The Future of Digital Money?

Cryptocurrency is a rapidly evolving technology with the potential to significantly impact the future of finance. While it offers exciting possibilities for decentralization, lower costs, and increased accessibility, it also comes with significant risks and challenges.

Understanding the fundamentals of what cryptocurrency is, how it works, and its potential implications is crucial in navigating this dynamic landscape. Whether it becomes a mainstream form of money or remains a niche asset, its underlying technology, the blockchain, is already proving to be a transformative innovation with applications far beyond just digital currencies.

By demystifying the jargon and focusing on the core concepts, we hope this article has provided you with a clearer understanding of what cryptocurrency is all about. The journey into the world of digital assets can be fascinating, just remember to tread carefully and always keep learning!