Introduction: Your Key to the Crypto Kingdom

Imagine diving into the exciting world of cryptocurrencies. You’ve learned about Bitcoin, Ethereum, and maybe even some of those quirky meme coins. You’re ready to take the plunge and acquire some digital assets. But where do you keep them? Unlike the physical cash in your wallet or the balance in your bank account, cryptocurrencies require a special kind of storage: a crypto wallet.

Think of a crypto wallet not as a physical container for your coins, but rather as a digital tool that allows you to interact with the blockchain. It securely stores the private keys that prove your ownership of your cryptocurrency and enables you to send, receive, and manage your digital assets.

Choosing the right crypto wallet is a crucial first step in your crypto journey. Just like choosing the right bank account or physical wallet depends on your needs and preferences, the best crypto wallet for you will depend on factors like the amount of crypto you hold, how frequently you plan to trade, and your comfort level with technology and security.

This article will be your comprehensive guide to understanding the different types of crypto wallets available, their pros and cons, and how to choose the one that best suits your individual needs and security priorities. We’ll break down the technical jargon and provide clear, human-friendly explanations to empower you to make an informed decision and keep your digital assets safe.

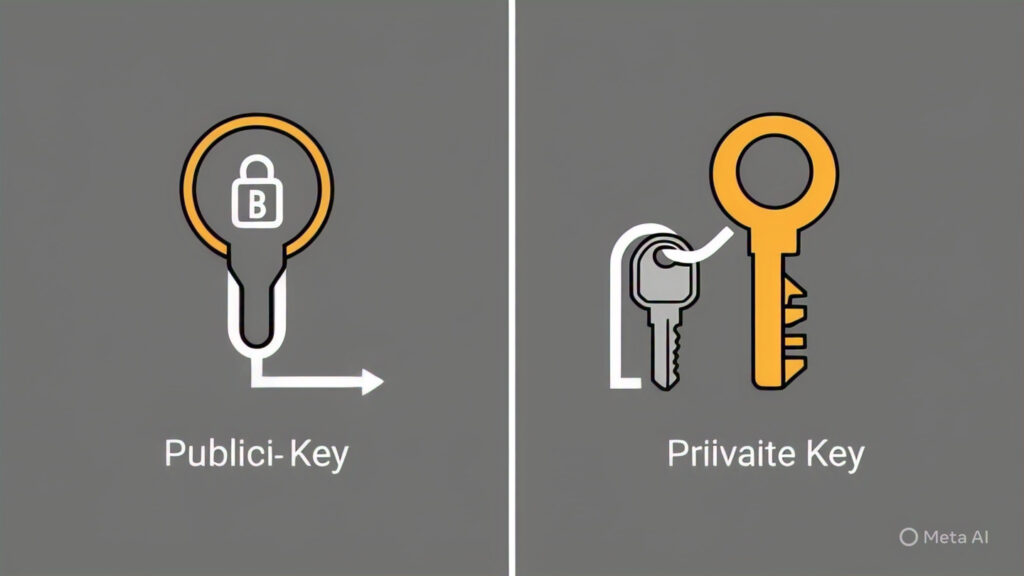

The Fundamental Concepts: Public and Private Keys (The Heart of Your Wallet)

Before we dive into the different types of wallets, it’s essential to understand the core concepts of public keys and private keys. These are the fundamental building blocks that make crypto wallets work:

- Public Key: Think of your public key as your crypto “address” or your bank account number. It’s a string of alphanumeric characters that you can safely share with others to receive cryptocurrency. When someone wants to send you Bitcoin, for example, they will send it to your Bitcoin public key.

- Private Key: Your private key is like the secret PIN or password to your crypto fortune, but far more powerful and critical. It’s a unique cryptographic code that proves you own the cryptocurrency associated with your public key and allows you to authorize transactions, essentially “signing off” on sending crypto to others. Crucially, your private key must be kept absolutely secret and never shared with anyone. Anyone who gains access to your private key has full control over your cryptocurrency – there’s no “undo” button in the crypto world.

Your crypto wallet doesn’t actually store your cryptocurrency in the traditional sense. Instead, it securely holds these public and private keys, enabling you to interact with the blockchain where your cryptocurrency’s balance is recorded.

Different Types of Crypto Wallets: Choosing Your Digital Fortress

Now that we understand the importance of keys, let’s explore the different types of crypto wallets available, each with its own set of trade-offs in terms of security, convenience, and accessibility:

1. Software Wallets: Convenience at Your Fingertips

Software wallets are applications that you can install on your computer (desktop wallet) or smartphone (mobile wallet). They offer a good balance of convenience and security for many users.

- Desktop Wallets: These are installed directly onto your computer. They offer more security than online wallets as your private keys are stored locally on your device. However, your security is still dependent on the security of your computer itself (e.g., being protected from malware).

- Pros: Generally more secure than online wallets, easy to use for frequent trading on your computer.

- Cons: Security depends on your computer’s security, can be vulnerable if your computer is compromised.

- Examples: Exodus, Electrum (Bitcoin only), Trust Wallet (also available on mobile).

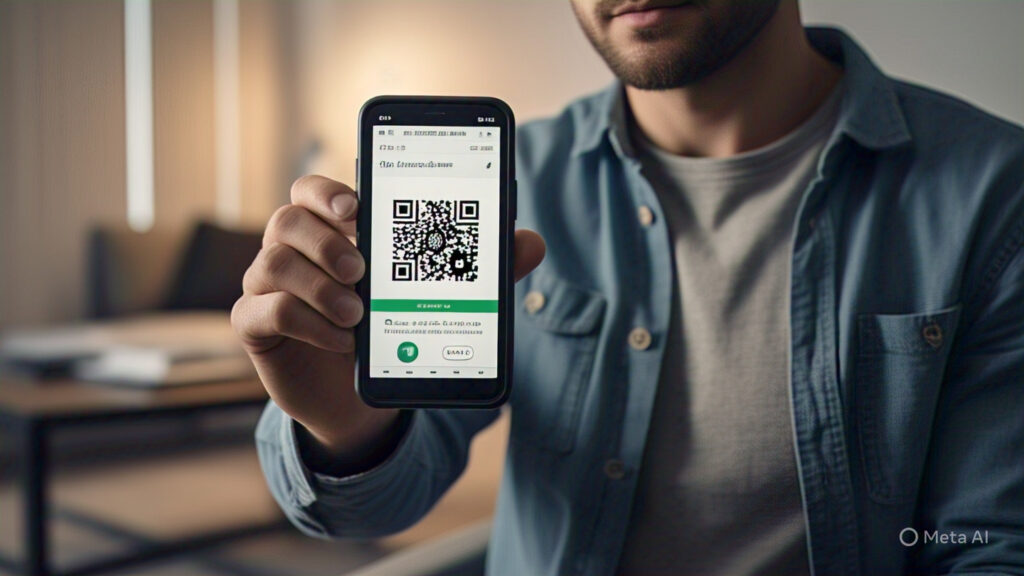

- Mobile Wallets: These are apps for your smartphone, offering excellent portability and convenience for on-the-go transactions. They often integrate features like QR code scanning for easy payments. However, like desktop wallets, their security is tied to the security of your mobile device.

- Pros: Very convenient for everyday transactions, easy QR code scanning, often user-friendly interfaces.

- Cons: Security depends on your phone’s security, risk of loss or theft of the device.

- Examples: Trust Wallet, MetaMask (also a browser extension), Coinbase Wallet (separate from the Coinbase exchange app).

- Web Wallets (Online Wallets): Convenience vs. Custody

Web wallets are accessible through a web browser. They are often provided by cryptocurrency exchanges. These are the most convenient option for accessing your crypto from any device with internet access. However, with many web wallets, the exchange or third-party typically holds your private keys for you, meaning you don’t have full custody of your funds. This introduces a risk: if the exchange is hacked or goes bankrupt, you could lose your cryptocurrency.

- Pros: Highly convenient, accessible from any device, often integrated with exchange trading platforms.

- Cons: Generally considered less secure as a third party holds your private keys (custodial), higher risk of hacks and exchange failures.

- Examples: Wallets provided by Binance, Kraken, Coinbase (for funds held on the exchange).

- Important Note: While exchange-provided wallets are technically web wallets, it’s generally recommended to store significant amounts of crypto in a non-custodial wallet where you control your private keys.

- Browser Extension Wallets: These are browser extensions that allow you to interact with decentralized applications (dApps) and manage your crypto directly within your web browser. They typically give you control of your private keys.

- Pros: Convenient for interacting with DeFi and Web3 applications, you control your private keys (non-custodial).

- Cons: Security relies on your browser’s security, potential risk of malicious extensions if not careful.

- Examples: MetaMask, Phantom (for Solana).

2. Hardware Wallets: The Gold Standard for Security

Hardware wallets are physical devices, similar in appearance to a USB drive, that store your private keys offline. This “cold storage” significantly reduces the risk of your keys being exposed to online threats like malware or phishing scams. To make a transaction, you need to physically connect the device to your computer or phone and authorize it, adding an extra layer of security.

- Pros: Highest level of security by storing private keys offline, resistant to online hacking attempts, often support multiple cryptocurrencies.

- Cons: Less convenient for frequent trading than software wallets, usually require a one-time purchase cost, need to be connected to a device to make transactions.

- Examples: Ledger Nano S/X, Trezor Model T/One.

3. Paper Wallets: An Offline, Physical Approach

A paper wallet involves printing your public and private keys (often as QR codes) on a piece of paper. This is a form of cold storage and can be very secure if handled correctly. However, it requires careful management and is less practical for frequent transactions. If the paper is lost, damaged, or compromised, your funds are also lost.

- Pros: Very secure if stored correctly as keys are entirely offline, no risk of online hacking.

- Cons: Inconvenient for frequent transactions, risk of physical loss or damage, requires careful generation and handling of keys.

- How it Works: Paper wallets are typically created using specialized websites that generate the key pairs. It’s crucial to use a reputable, offline generator to minimize risks.

4. Brain Wallets: Security Risk in Memorization

A brain wallet involves memorizing your private key. While technically a way to keep your keys “offline” in your mind, this method is extremely risky and highly discouraged. Human memory is fallible, and if you forget or incorrectly recall your private key, you will lose access to your funds. Additionally, there are ways for others to potentially guess or derive private keys created in this manner.

- Pros: Theoretically free and offline.

- Cons: Extremely high risk of losing access to funds due to memory issues or key compromise, strongly not recommended for storing any significant amount of cryptocurrency.

How to Choose the Right Crypto Wallet: Key Considerations

Choosing the best crypto wallet for you depends on several factors:

1. Security Needs: How Much Crypto Do You Hold?

If you’re holding a significant amount of cryptocurrency, security should be your top priority. In this case, hardware wallets are generally considered the most secure option due to their offline storage of private keys. For smaller amounts or for crypto you actively trade, a reputable software wallet might suffice. Avoid storing large amounts on web wallets or exchanges for extended periods.

2. Frequency of Transactions: How Often Do You Use Your Crypto?

If you plan to use your cryptocurrency frequently for payments or trading, mobile wallets offer the most convenience. Desktop wallets are also suitable for regular trading on your computer. Hardware wallets are less convenient for frequent use as they need to be physically connected and transactions authorized. Paper wallets are best suited for long-term storage of crypto you don’t plan to access often.

3. User-Friendliness: How Comfortable Are You with Technology?

Some wallets are designed with beginners in mind, offering simple and intuitive interfaces. Others offer more advanced features that may be better suited for experienced users. Consider your technical comfort level when choosing a wallet. Mobile and many desktop wallets tend to be user-friendly. Hardware wallets often have a slight learning curve initially. Paper wallets require careful handling and understanding.

4. Supported Cryptocurrencies: Does the Wallet Support Your Assets?

Not all wallets support all cryptocurrencies. Make sure the wallet you choose supports the specific cryptocurrencies you plan to hold or use. Most popular wallets support major cryptocurrencies like Bitcoin and Ethereum, but support for smaller altcoins can vary. Always verify compatibility before transferring funds.

5. Custodial vs. Non-Custodial: Who Controls Your Keys?

As discussed earlier, custodial wallets (like those on many exchanges) hold your private keys for you. Non-custodial wallets (like most software, hardware, and paper wallets) give you full control of your private keys. For maximum security and control, non-custodial wallets are generally recommended for storing significant amounts of crypto.

6. Backup and Recovery Options: What Happens if You Lose Your Wallet?

Reputable wallets will provide you with a seed phrase (a series of 12-24 words) during setup. This seed phrase is crucial for recovering your wallet and funds if your device is lost, stolen, or damaged. Store your seed phrase securely offline and never share it with anyone.

7. Multi-Signature (Multi-Sig) Support: Enhanced Security for Groups

For teams or individuals wanting an extra layer of security, some wallets offer multi-signature functionality. This requires multiple private keys to authorize a transaction, meaning a single compromised key cannot lead to the loss of funds.

Best Practices for Securing Your Crypto Wallet: Protecting Your Digital Assets

Regardless of the type of wallet you choose, it’s crucial to follow best practices to protect your cryptocurrency:

- Never Share Your Private Keys: This is the golden rule of crypto security.

- Secure Your Seed Phrase: Write it down on paper and store it in a safe, offline location. Never store it digitally or take a picture of it.

- Enable Two-Factor Authentication (2FA): Use 2FA whenever possible, especially on exchange accounts.

- Be Wary of Phishing Scams: Be cautious of emails, messages, or websites that try to trick you into revealing your private keys or seed phrase.

- Keep Your Software Updated: Regularly update your operating system and wallet software to patch security vulnerabilities.

- Use Strong Passwords: Protect your devices and software wallets with strong, unique passwords.

- Consider Using a Separate Device for Crypto: If you handle large amounts of crypto, consider using a dedicated computer or phone that is not used for general browsing or email.

- Verify Addresses Before Sending: Double-check the recipient’s address carefully before sending any cryptocurrency. Transactions are irreversible.

Conclusion: Choosing Wisely for a Secure Crypto Journey

Choosing the right crypto wallet is a fundamental decision that significantly impacts the security and convenience of managing your digital assets. By understanding the different types of wallets available – from the convenience of software wallets to the robust security of hardware wallets – and considering your individual needs and risk tolerance, you can select the digital vault that best safeguards your crypto holdings.

Remember that security is a continuous effort. By adopting best practices and staying informed about potential threats, you can navigate the exciting world of cryptocurrency with greater confidence and peace of mind, knowing that your digital keys are well-protected. The journey into crypto starts with a single step, and choosing the right wallet is a crucial one on the path to mastering the digital frontier.