Introduction: Investing Without the Anxiety – A Simpler Path to Crypto

The world of cryptocurrency can feel like a rollercoaster. One day, prices are soaring, and the next, they’re plummeting faster than a shooting star. For newcomers and even seasoned investors, this volatility can be a major source of stress and uncertainty. You might find yourself constantly checking charts, agonizing over the perfect entry point, and feeling a pang of regret every time the market moves against you.

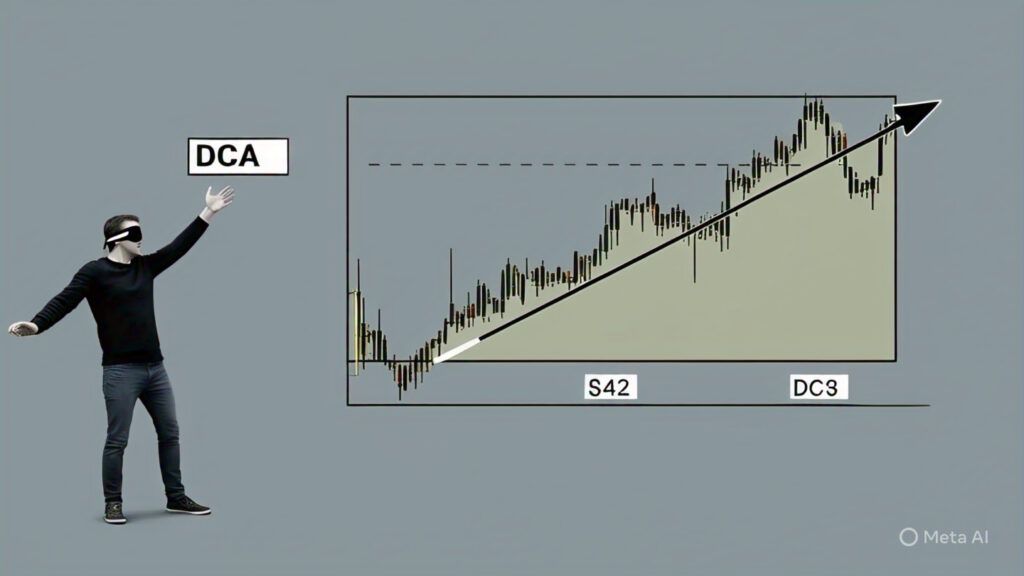

But what if there was a way to navigate this turbulent landscape with a little more peace of mind? Enter Dollar-Cost Averaging (DCA). Think of DCA as your steady, reliable friend in the often-chaotic world of crypto investing. It’s a simple yet powerful strategy that takes the emotional rollercoaster out of the equation by focusing on consistent, regular investments, regardless of the current price.

This guide will walk you through the ins and outs of Dollar-Cost Averaging for crypto, explaining why it’s a valuable tool, how it works in practice, its benefits and drawbacks, and how you can implement it effectively to build your crypto portfolio over time, without constantly trying to time the market perfectly (which, let’s be honest, is nearly impossible).

Why Timing the Crypto Market is a Fool’s Errand (and Why DCA Offers a Better Way)

One of the biggest temptations in crypto investing is trying to “time the market” – buying low and selling high. While the idea is appealing, the reality is that accurately predicting the peaks and troughs of the crypto market with any consistent success is incredibly difficult, even for experienced traders.

Here’s why market timing is so challenging in the crypto space:

- Extreme Volatility: Crypto prices can swing dramatically in short periods, often driven by news, sentiment, and unforeseen events.

- Emotional Decision-Making: The fear of missing out (FOMO) can lead to buying at inflated prices, while panic selling during dips can lock in losses.

- Lack of Predictable Patterns: Unlike traditional markets, crypto often lacks the long history and established patterns that some technical analysts rely on.

- Information Overload: The constant influx of news, rumors, and social media chatter can cloud judgment and lead to impulsive decisions.

Dollar-Cost Averaging offers a refreshing alternative. Instead of trying to guess the perfect moment to buy a large sum, you invest a fixed amount of money at regular intervals (e.g., weekly, bi-weekly, or monthly), regardless of the price. This systematic approach helps to smooth out your average purchase price over time, reducing the impact of volatility and the risk of making emotionally driven decisions.

How Dollar-Cost Averaging Works: Simple Steps to Consistent Investing

The beauty of Dollar-Cost Averaging lies in its simplicity. Here’s a step-by-step breakdown of how it works:

- Choose a Crypto Asset: Decide which cryptocurrency you want to invest in (e.g., Bitcoin, Ethereum, or others you’ve researched).

- Determine Your Investment Amount: Decide how much money you’re comfortable investing at each interval (e.g., $50, $100, $500). This should be an amount you can consistently afford.

- Set a Regular Investment Schedule: Choose a consistent interval for your investments (e.g., every week on Monday, the first and fifteenth of each month).

- Stick to Your Plan: The most crucial step is to consistently invest the predetermined amount at your chosen intervals, regardless of the current price of the asset. This means buying even when the price is high and especially when it’s low.

- Invest Over Time: DCA is a long-term strategy. The benefits become more apparent over extended periods, allowing you to accumulate more assets when prices are down and fewer when prices are up, ultimately leading to a potentially lower average cost per coin.

Example Scenario:

Let’s say you decide to invest $100 in Bitcoin every month for six months:

- Month 1: Bitcoin Price = $40,000. You buy 0.0025 BTC.

- Month 2: Bitcoin Price = $35,000. You buy 0.00286 BTC.

- Month 3: Bitcoin Price = $45,000. You buy 0.00222 BTC.

- Month 4: Bitcoin Price = $50,000. You buy 0.002 BTC.

- Month 5: Bitcoin Price = $30,000. You buy 0.00333 BTC.

- Month 6: Bitcoin Price = $40,000. You buy 0.0025 BTC.

Over six months, you invested a total of $600 and accumulated approximately 0.01541 BTC. Your average cost per Bitcoin is $600 / 0.01541 = approximately $38,935.

Notice how you bought more Bitcoin when the price was lower ($30,000 and $35,000) and less when the price was higher ($45,000 and $50,000). This is the core advantage of DCA.

The Sweet Benefits of Dollar-Cost Averaging in the Crypto World

DCA offers several compelling advantages for crypto investors, particularly in such a volatile market:

- Reduces the Risk of Poor Timing: By spreading your purchases over time, you lessen the impact of buying a large amount at the absolute peak. You’re less likely to experience the immediate disappointment of a significant price drop right after a large investment.

- Lowers Average Purchase Cost Over Time: DCA capitalizes on market dips. When prices fall, your fixed investment buys you more of the asset, potentially leading to a lower average cost per coin over the long run compared to buying a lump sum at the beginning.

- Removes Emotional Decision-Making: By automating your investments, you take the stress and emotion out of the equation. You’re less likely to make impulsive buying or selling decisions based on short-term market fluctuations.

- Simplicity and Discipline: DCA is a straightforward strategy that’s easy to understand and implement. It encourages consistent investment habits and long-term thinking, which are crucial for wealth building.

- Accessibility for All Investors: You don’t need a large amount of capital to start using DCA. You can begin with small, regular investments that fit your budget.

- Potentially Higher Returns in the Long Run: While not guaranteed, historically, assets that have trended upwards over the long term have yielded better returns with DCA compared to trying to time the market and potentially missing out on significant gains.

Are There Any Downsides to Dollar-Cost Averaging? A Balanced Perspective

While DCA offers significant benefits, it’s important to acknowledge its potential drawbacks:

- Potentially Lower Returns in a Consistently Bull Market: If the price of the crypto asset you’re investing in rises consistently and rapidly, investing a lump sum at the beginning might yield higher overall returns than spreading your purchases over time. However, predicting such a scenario with certainty is difficult.

- Slower Accumulation: DCA involves smaller, regular investments, which means it might take longer to accumulate a substantial amount of the asset compared to a large initial investment.

- Transaction Fees: Depending on the exchange or platform you use, frequent small transactions might incur more in cumulative transaction fees compared to a single large purchase. However, many platforms are offering lower fees or options for recurring buys to mitigate this.

- Missed Initial Gains: If you delay investing a large sum hoping for a dip that never comes, you might miss out on the initial upward price movement.

Implementing Dollar-Cost Averaging for Your Crypto Journey: Practical Steps

Getting started with Dollar-Cost Averaging for your crypto investments is easier than you might think:

- Choose a Reputable Crypto Exchange or Platform: Select a platform that offers recurring buy options or allows you to easily make regular purchases. Research their fees, security, and user-friendliness. Popular options include Coinbase, Binance, Kraken, Gemini, and many others.

- Set Up Recurring Buys (If Available): Many exchanges allow you to automate your DCA strategy by setting up recurring buy orders at your chosen interval and amount. This makes the process truly hands-off.

- Manually Schedule Your Investments: If recurring buys aren’t available or you prefer more control, set reminders in your calendar to manually make your purchases at your chosen intervals.

- Stay Consistent: The key to successful DCA is consistency. Resist the urge to deviate from your plan based on short-term market noise. Stick to your schedule, even when the market looks scary or overly optimistic.

- Focus on the Long Term: DCA is a strategy for long-term wealth building. Don’t expect overnight riches. Be patient and allow your investments to compound over time.

- Review and Adjust (If Necessary): Periodically review your portfolio and your DCA strategy. While consistency is important, you might consider adjusting your investment amount or the assets you’re investing in based on your evolving financial situation and investment goals.

- Don’t Forget About Security: As you accumulate more crypto, ensure you’re taking appropriate security measures, such as enabling two-factor authentication (2FA) on your exchange account and considering moving your holdings to a secure hardware wallet for long-term storage.

Dollar-Cost Averaging vs. Lump Sum Investing: Which is Right for You?

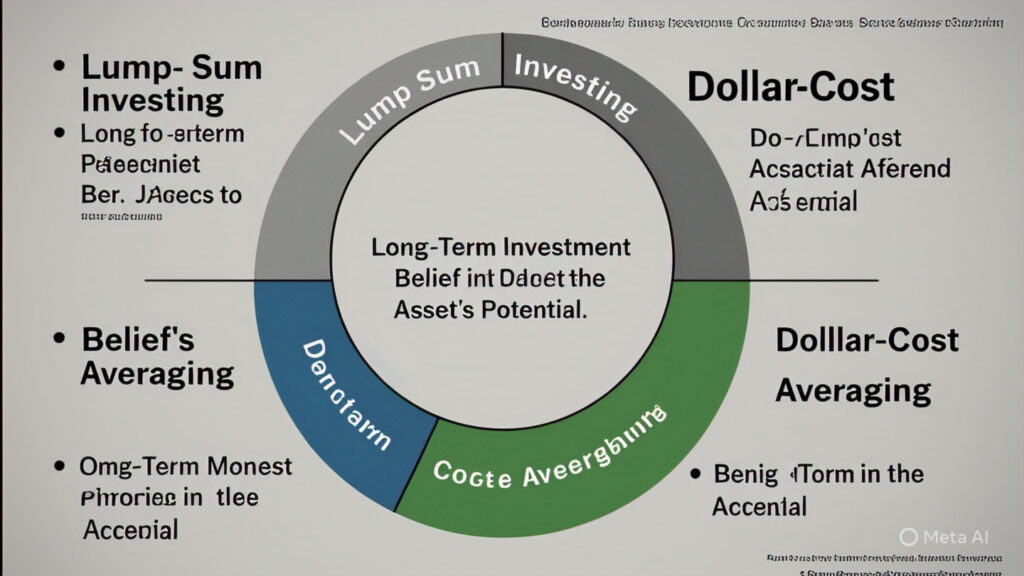

The choice between Dollar-Cost Averaging and lump sum investing depends on your individual circumstances, risk tolerance, and market outlook.

- Lump Sum Investing: Involves investing a large sum of money all at once. This can lead to higher returns if the market rises quickly after your purchase, but it also exposes you to greater risk of losses if the market drops immediately. It’s generally considered more suitable for investors who have a large amount of capital available immediately and are comfortable with higher short-term volatility.

- Dollar-Cost Averaging: Involves investing a fixed amount of money at regular intervals. It reduces the risk of poor timing and can lead to a lower average purchase cost over time, but it might result in lower overall returns compared to a well-timed lump sum investment in a consistently rising market. It’s often favored by investors who prefer a more gradual and less stressful approach, especially in volatile markets like crypto.

A General Guideline: If you have a large sum of capital available and are confident in the long-term prospects of the asset and are comfortable with potential short-term volatility, a lump sum investment could be more beneficial. However, given the inherent volatility of the crypto market, Dollar-Cost Averaging is often the more prudent and psychologically sound approach for most investors, especially those who are new to the space or prefer a less risky strategy.

Conclusion: A Step-by-Step Approach to Building Your Crypto Future

Dollar-Cost Averaging is more than just an investment strategy; it’s a mindset. It’s about embracing consistency over speculation, patience over panic, and a long-term vision in the often-frenetic world of cryptocurrency. By implementing a disciplined DCA approach, you can navigate the volatility, reduce the stress of trying to time the market, and gradually build your crypto portfolio over time, one steady investment at a time.

Remember that while DCA can help mitigate risk, it doesn’t eliminate it entirely. The value of your crypto assets can still go down. However, by taking a systematic and consistent approach, you’re setting yourself up for a potentially more rewarding and less emotionally draining journey in the exciting world of cryptocurrency investing. Start small, stay consistent, and let time work its magic.